Disability offsets – Can I receive two sources of disability income at once?

There are many different programs available for the disabled and in some situations they intersect.

Author: Attorney Lonnie Roach

Updated: 12/19/2023

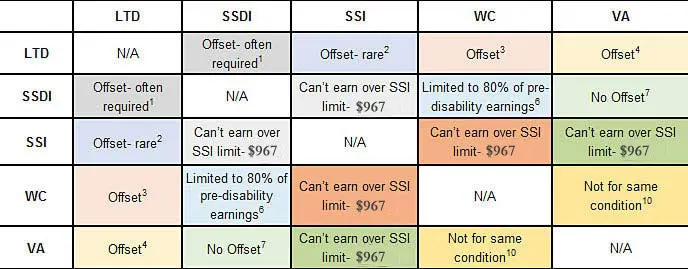

Private Long-Term Disability Insurance, Social Security Disability Insurance, Supplemental Security Income, Worker’s Compensation benefits, Veteran’s Administration benefits are all targeted towards helping people who cannot support themselves. In many situations they overlap and someone may be eligible for more than one program. In some instances, an individual may be able to collect benefits from multiple programs, but in other cases benefits may be restricted or offset.

Disability sources overlap and in some instances, you may be able to collect benefits from multiple programs, but in other cases benefits may be restricted or offset.

I. Long Term disability offsets

It is important to note that LTD policies vary from insurer to insurer. ERISA does not have specific language detailing what can and can’t be taken as an offset. In the insurance policy, usually under the heading “Other Income”, you can find what benefits count as an offset for your particular policy.

1. Long Term disability and Social Security Disability Insurance

Many people collect both Long-Term Disability Insurance and Social Security Disability Insurance. Generally LTD Insurers require beneficiaries to file for SSDI as it offsets the amount the insurer must pay. For example if the insurer is paying $3,000 per month and then the beneficiary wins $1,000 month in SSDI benefits, the insurer will only be required to pay $2,000 per month.

2. Long Term disability and Supplemental Security Income

While it’s possible to collect both, it would be unusual. Supplemental Security Income requires that the applicant have less than $2,000 in total assets. Generally, LTD claimants do not meet this requirement and they are more likely to have a sufficient work history for SSDI benefits. Also, SSI pays a maximum of $967/mo (2025) and most LTD policies would entirely offset this amount.

3. Long Term disability and Worker’s Comp.

It is possible to collect both Long-Term Disability Insurance and Worker’s Compensation. It depends on the policy, but generally Worker’s Compensation will offset LTD benefits. Because Worker’s Compensation covers more than lost wages, sometimes the offset to LTD benefits is not the entire amount of the Worker’s Comp. benefit. Check your policy and consult with your attorney for further details.

4. Long Term disability and VA Benefits

Like Worker’s Compensation, VA benefits may only partially offset an LTD insurer’s liability. Insurance policies will describe what other income counts as an offset and what does not. If the policy does not specifically mention VA benefits, it is likely the insurer cannot use them as an offset. Review your policy and consult an attorney.

If you have been denied disability you may still qualify for benefits. Contact an experienced Social Security disability attorney at 512-454-4000 and get help today

II. Social Security Disability Insurance disability offsets

5. Social Security Disability Insurance and Supplemental Security Income

Generally people who are approved for both programs receive a low SSDI benefit in order to stay under the $967/mo (2025) income limit. SSDI benefit amounts are based on previous income and work history. If you receive both SSDI and SSI, you cannot earn more than you would on SSI alone.

6. Social Security Disability Insurance and Worker’s Comp.

If someone is injured on the job, they are likely eligible for both Worker’s Compensation and SSDI. Individuals receiving both SSDI and Worker’s Compensation are limited to 80% of their average current earnings before becoming disabled.

7. Social Security Disability Insurance and VA Benefits

Social Security Disability Insurance has a special provision which specifically excludes VA benefits from being counted as income, meaning you are generally able to collect VA benefits and SSDI concurrently with no reduction in either benefit. However, the VA counts SSDI benefits as income in some circumstances and if you have a non-service connected pension it may be affected by SSDI benefits.

III. Supplemental Security Income disability offsets

8. Supplemental Security Income and Worker’s Comp.

In general, those receiving worker’s compensation are not likely to be eligible for SSI as worker’s compensation counts as income towards SSI’s $967/mo limit (2025) and they may have over the $2,000 asset limit. Worker’s compensation offsets SSI the same way any other income would.

Partner Lonnie Roach – Focuses his practice on ERISA long term disability law and can help you with your denied disability claim. Call 512-454-4000 for help today.

9. Supplemental Security Income and VA Benefits

Again, individuals who qualify for VA benefits are likely bringing in more than the SSI income limit of $967/mo. VA benefits would offset SSI benefits the same way any income would and SSI benefits will generally count as income in calculating VA benefits.

10. VA Benefits and Worker’s Comp

Because Worker’s Compensation claims are claims for on-the-job injuries in civilian jobs and VA benefits are for service-connected disabilities, you could not collect VA benefits and Worker’s Compensation for the same condition. However, it is possible to collect both at the same time for separate conditions.

Our client came to us for help with a Long Term Disability claim that had been denied.

I noticed that the client likely qualified for Social Security Disability (SSDI) and put her in contact with my partner Greg Reed to help with that claim. The Social Security claim ultimately went to an administrative hearing in which we prevailed. In the meantime, my client’s Long Term Disability appeal had been denied and we were preparing to file a lawsuit. After winning the SSDI claim, however, we changed course and filed another appeal of the Long Term Disability denial including our newly won, fully favorable decision from Social Security. Even though the Long Term Disability appeal period had ended, the carrier reviewed the appeal again and granted it.

Our client now receives both the Social Security and Long Term Disability benefits she is entitled to and we did not have to file a lawsuit. Here at Bemis, Roach & Reed, we are always looking out for our clients best interest.

The attorneys at Bemis, Roach and Reed specialize in helping people appeal their Social Security Disability (SSDI) and Long-Term Disability claims. If you have been denied by Social Security or a private insurer such as Unum, CIGNA, Prudential, or The Hartford, you can appeal your claim. Most initial applications are denied. Having an attorney with knowledge and experience can help win your claim. Contact the Law Office of Bemis, Roach and Reed today for a free consultation. Call 512-454-4000 and get help NOW.

Employees Retirement System (ERS)

Austin ERISA Attorneys

Working while getting Disability

Your Free Initial Consultation

Call now:

At Bemis, Roach and Reed, if we can't help you, we will try to find the right attorneys for you.

We offer each of our prospective clients a free no obligation one hour phone or office consultation to see if we can help you and if you are comfortable with us. We know how difficult a time like this can be and how hard the decisions are. If we can be of assistance to you and help you find a solution to your issue we will, even if that means referring you to another attorney.

Let's get you Started:

If you could provide us with some basic information about your claim we will get right back with you with a free case evaluation and schedule your Free Consultation Today.

You can also email us at: contact@brrlaw.com

Your Free Initial Consultation

Call now:

At Bemis, Roach and Reed, if we can’t help you, we will try to find the right attorneys for you.

We offer each of our prospective clients a free no obligation one hour phone or office consultation to see if we can help you and if you are comfortable with us. We know how difficult a time like this can be and how hard the decisions are. If we can be of assistance to you and help you find a solution to your issue we will, even if that means referring you to another attorney.

Let’s get you Started:

If you could provide us with some basic information about your claim we will get right back with you with a free case evaluation and schedule your Free Consultation Today.