What To Do When Someone I know becomes Disabled Part 2

DISABILITY LAW – What To Do When a Client or Someone I know becomes Disabled – Part 2

Author Attorney Greg Reed:

Updated: 1/31/2023

This is Part 2 of a speech presented by Bemis, Roach & Reed partner Greg Reed at the

CAPITAL AREA PARALEGAL ASSOCIATION in Austin Texas, April 27, 2016

This Document can be downloaded in it’s entirety in PDF format here

On To Part 3 –>

<- Back to Part 1

Greg Reed is a partner in the Austin law firm of Bemis, Roach & Reed. He received his law degree in 1991 from the University of Texas at Austin. He is Board Certified in Personal Injury Trial Law by the Texas Board of Legal Specialization and AV rated by Martindale-Hubbell. He has been SuperLawyers® Rated by Thomson Reuters. Mr. Reed is admitted to every federal district in Texas and is a recognized authority in representing claimants with Long Term Disability and Social Security Disability claims.

Acknowledgement

My law partner, Lonnie Roach, researched and wrote the section of this paper related to ERISA disability. Lonnie Roach is a partner in the Austin law firm of Bemis, Roach & Reed. He received his law degree in 1991 from the University of Texas at Austin. He is Board Certified in Personal Injury Trial Law by the Texas Board of Legal Specialization and AV rated by Martindale-Hubbell. He has been SuperLawyers® Rated by Thomson Reuters. Mr. Roach is admitted to every federal district in Texas and focuses his practice on representing claimants with ERISA Long Term Disability claims.

TABLE OF CONTENTS

Part 1

PUBLIC DISABILITY BENEFITS –SSDI AND SSI

- Definition of Disability

- Disability Determination

- Appeal Process

Part 2

PRIVATE DISABILITY – CLAIMS AGAINST DISABILITY INSURERS

- What is an ERISA plan?

- Should be in writing.

- What minimum indicia can define a plan – insurance policy, criterion/critical factors?

- Some plans fall within the Safe Harbor provision.

- What is not an ERISA plan?

- Who are the plan principals?

- Who are fiduciaries?

- What is the obligation of a fiduciary?

Part 3

CONSIDERATIONS WHEN EVALUATING AN ERISA CLAIM:

- Time Limits: Notice of Claim/Proof of Loss/Statute of Limitations

- Claim Process

- Appeal Process

- Exhaustion of Remedies

- Lawsuit For Benefits

- Standard of Review

- Discovery

- Remedy

CONCLUSION

DISABILITY LAW OVERVIEW

Americans are filing for disability benefits at a startling rate. Since 2003, there has been a 44% increase in disability claims filed by people previously in the workplace. Claims for disability by individuals with little or no work experience increased by 29% over the same time. The conjecture is that a combination of an aging population and a slowing economy caused the growth in disability claims.

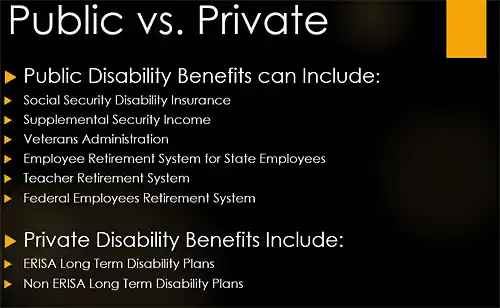

Public or Private

Disability benefits come from many different sources and the rules for obtaining benefits change based on the source of the benefit. This paper will discuss the most common public disability benefits, Social Security Disability Insurance and Supplemental Security Income, and will also discuss the most common private disability insurance. It does not address veteran’s disability benefits or federal employee disability benefits.

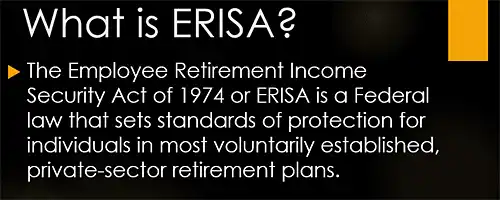

Insurance is intended to provide protection against the risks insureds face in life. Some risks, such as the risk of injury or illness, loss of the ability to work, or loss of life itself are so severe and life-altering, that employers and trade organizations want to protect their employees or members from these risks and deliver vital coverage by means of affordable, group rates, or as an employee benefit to supplement salaries. When an employee obtains his coverage in this way, there is a good chance the coverage delivered is more than simple insurance—it is an ERISA plan. It is important to understand the distinction between ERISA coverage and insurance when a dispute arises over the denial of benefits.

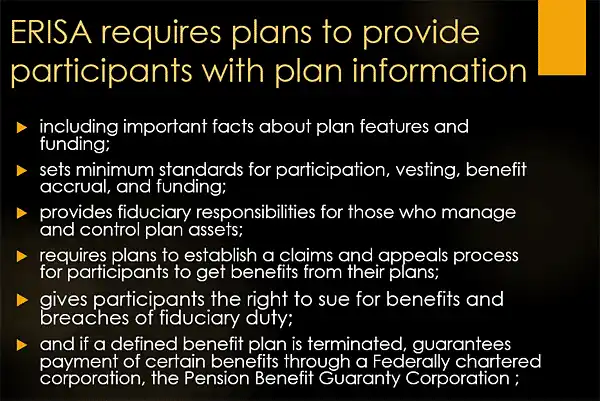

The Employee Retirement Income Security Act of 1974, better known as ERISA, was enacted to ensure that employees receive the pension and other benefits promised by their employers and to encourage employers to provide benefits to their employees. Most Americans today receive their health benefits through “welfare benefit plans,” that are governed by ERISA. Death and Long Term Disability benefits are also commonly provided as employee benefits under ERISA plans and thus subject to its governance. Oftentimes employers provide these benefits through the purchase of insurance covering their employees. When evaluating a dispute between a claimant and a plan, the most important question to ask is perhaps: “Who purchased the coverage?” If the answer is the claimant’s employer, then in all likelihood the dispute is governed by ERISA. This is a crucial determination to make because the laws and regulations impacting the claim vary considerably, and not necessarily intuitively, from those governing traditional insurance and contracts.

A. What is an ERISA plan?

“The terms ’employee welfare benefit plan’ and ‘welfare plan’ mean any plan, fund, or program which was . . . established or maintained by an employer or by an employee organization . . . to the extent that such plan, fund, or program was established . . . for the purpose of providing for its participants or their beneficiaries, through the purchase of insurance or otherwise, (A) medical, surgical, or hospital care or benefits, or benefits in the event of sickness, accident, disability, death or unemployment, or vacation benefits, apprenticeship or other training programs, or day care centers, scholarship funds, or prepaid legal services, or (B) any benefit described in section 186(c) [holiday benefits, among others] of this title (other than pensions on retirement or death, and insurance to provide such pensions).

(2)(A) Except as provided in subparagraph (B) [relating to severance pay arrangements and supplemental retirement income payments], the terms ’employee pension benefit plan’ and ‘pension plan’ mean any plan, fund, or program which was . . . established . . . by an employer or by an employee organization . . . to the extent that by its express terms or as a result of surrounding circumstances such plan, fund, or program – (i) provides retirement income to employees, or (ii) results in a deferral of income by employees for periods extending to the termination of covered employment or beyond, regardless of the method of calculating the contributions made to the plan, the method of calculating the benefits under the plan or the method of distributing benefits from the plan.”

29 U.S.C. ‘ 1002(1) (emphasis supplied)

B. Should be in writing.

Every employee benefit plan should be established and maintained pursuant to a written instrument. The written instrument “shall provide for one or more named fiduciaries who jointly or severally shall have authority to control and manage the operation and administration of the plan.” 29 U.S.C. ‘ 1102(a)(1).

C. What minimum indicia can define a plan – insurance policy, criterion/critical factors?

(1) A plan, fund or program, (2) established or maintained, (3) by an employer or by an employee organization, or by both, (4) for the purpose of providing medical, surgical, hospital care, sickness, accident, disability, death, unemployment or vacation benefits, apprenticeship or other training programs, day care centers, scholarship funds, pre-paid legal services or severance benefits, (5) to participants or their beneficiaries. Donovan v. Dillingham, 688 F.2d 1367, 1371 (11th Cir. 1982) (en banc). In discussing the statutory elements, Donovan held that a “plan fund, or program under ERISA implies the existence of intended benefits, intended beneficiaries, a source of financing, and a procedure to apply for and collect benefits.” Id. at 1372.

An ERISA plan can be held to exist in the absence of a written plan document or compliance with other ERISA requirements. Id.

The test is whether a reasonable person could ascertain from the surrounding circumstances:

- intended benefits,

- intended beneficiaries,

- a source of financing, and

- a procedure for obtaining benefits. Id.

An ERISA plan can be established without a name or without formal documentation.

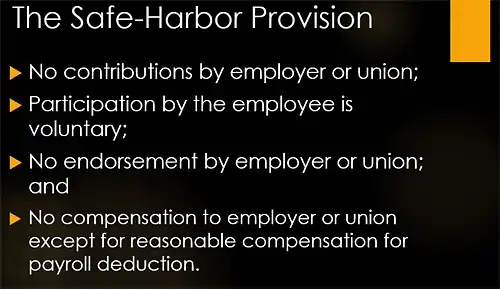

D. Some plans fall within the Safe Harbor provision.

Not all employer-provided plans are governed by ERISA. Federal regulations set out how an employer might establish a plan to be paid for with payroll deductions but still fall within the “Safe Harbor” and not subject to ERISA:

- no contributions by employer or union;

- participation by the employee is voluntary;

- no endorsement by employer or union; and

- no compensation to employer or union except for reasonable compensation for payroll deduction. 29 C.F.R. ‘ 2510.3-1(j).

E. What is not an ERISA plan?

Some employee benefit plans are exempted from ERISA solely due to the nature of the employer. ERISA provides that it shall not apply to any employee benefit plan if –

- such plan is a governmental plan (as defined in section 1002(32) of the title);

- such plan is a church plan (as defined in section 1002(33) of the title) with respect to which no election has been made under section 410(d) of title 26;

- such plan is maintained solely for the purpose of complying with applicable workmen’s compensation laws or unemployment compensation or disability insurance laws;

- such plan is maintained outside of the United States primarily for the benefit of persons substantially all of whom are nonresident aliens; or

- such plan is an excess benefit plan (as defined in section 1002(36) of the title) and is unfunded.

29 U.S.C. ‘ 1003(b).

F. Who are the plan principals?

“The term ’employer’ means any person acting directly as an employer, or indirectly in the interest of an employer, in relation to an employee benefit plan; and includes a group or association of employers acting for an employer in such capacity. ” 29 U.S.C. ‘ 1002(5).

“The term ’employee’ means any individual employed by an employer.” 29 U.S.C. ‘ 1002(6).

“The term ‘participant’ means any employee or former employee of an employer, or any member or former member of an employee organization, who is or may become eligible to receive a benefit of any type from an employee benefit plan which covers employees of such employer or members of such organization, or whose beneficiaries may be eligible to receive any such benefit.” 29 U.S.C. ‘ 1002(7).

“The term ‘beneficiary’ means a person designated by a participant, or by the terms of an employee benefit plan, who is or may become entitled to a benefit thereunder.” 29 U.S.C. ‘ 1002(8).

“The term ‘administrator’ means (i) the person specifically designated by the terms of the instrument under which the plan is operated.” 29 U.S.C. ‘ 1002(16)(A). The statutory definition makes clear that an employer can be a plan administrator. 29 U.S.C. ‘ 1002(16)(A)(ii). ERISA defines [plan] administrator as: A(i) the person specifically so designated by the terms of the instrument under which the plan is operated; and (ii) if an administrator is not so designated,. . .” (29 U.S.C. ‘ 1002(16)(A) the administrator by default would be the plan sponsor.

“The term ‘plan sponsor’ means the employer in the case of an employee benefit plan established or maintained by a single employer.” 29 U.S.C. ‘ 1002 (16)(B)(i).

G. Who are fiduciaries?

A named fiduciary is [1] “a fiduciary who is named in the plan instrument, or [2] who, pursuant to a procedure specified in the plan, is identified as a fiduciary.” 29 U.S.C. § 1102(a)(2).

A plan may allocate fiduciary responsibilities. A plan document may expressly provide for procedures for allocating fiduciary responsibilities (other than trustee responsibilities) among named fiduciaries. U.S.C. ‘ 1105(c)(1)(A).

A plan document may expressly provide for procedures for named fiduciaries to designate persons other than named fiduciaries to carry out fiduciary responsibilities. 29 U.S.C. ‘ 1105(c)(1)(B).

ERISA requires that any procedures for allocating responsibilities for the operation and administration of a plan must be described under the plan. 29 U.S.C. ‘ 1102(b)(2).

Except as otherwise provided in subparagraph (B), a person is a fiduciary with respect to a plan to the extent (i) he exercises any discretionary authority or discretionary control respecting management of such plan or exercises any authority or control respecting management or disposition of its assets, (ii) he renders investment advice for a fee or other compensation, direct or indirect, with respect to any moneys or other property of such plan, or has any authority or responsibility to do so, or (iii) he has any discretionary authority or discretionary responsibility in the administration of such plan. Such term includes any person designated under section 1105(c)(1)(B) of this title. 29 U.S.C. ‘ 1002 (21)(A).

H. What is the obligation of a fiduciary?

- Prudent man standard of care.

a. Subject to sections 1103(c) and (d), 1342, and 1344 of the title, a fiduciary shall discharge his duties with respect to a plan solely in the interest of the participants and beneficiaries and –- for the exclusive purpose of:

- providing benefits to participants and their beneficiaries; and

- defraying reasonable expenses of administering the plan;

- with the care, skill, prudence, and diligence under the circumstances then prevailing that a prudent man acting in a like capacity and familiar with such matters would use in the conduct of an enterprise of a like character and with like aims;

- by diversifying the investments of the plan so as to minimize the risk of large losses, unless under the circumstances it is clearly prudent not to do so; and

- in accordance with the documents and instruments governing the plan insofar as such documents and instruments are consistent with the provisions of this subchapter and subchapter III of this chapter.29 U.S.C. ‘ 1104.

On To Part 3 –>

<- Back to Part 1

The team of disability lawyers at Bemis, Roach & Reed knows how crucial disability benefits can be for maintaining financial stability. Our attorneys are assisting clients with their disability cases in cities all across Texas, including Austin, Houston, Dallas, Fort Worth, Galveston, and Corpus Christi. If you are seeking disability benefits because of a sleep apnea diagnosis, contact our attorneys today at no cost to you. Contact us today for a free consultation.

Call 512-454-4000 and get help NOW.

Try these links for further reading on this subject:

ERISA

Profile for Partner Greg Reed

Long Term Disability Practice Area

Author: Attorney Greg Reed has been practicing law for 29 years. He is Superlawyers rated by Thomson Reuters and is Top AV Preeminent® and Client Champion Gold rated by Martindale Hubbell. Through his extensive litigation Mr. Reed obtained board certification from the Texas Board of Legal Specialization. Greg is admitted to practice in the United States District Court - all Texas Districts and the United States Court of Appeals-Fifth Circuit. Mr. Reed is a member of the Travis County Bar Association, Texas Trial Lawyers Association, past Director of the Capital Area Trial Lawyers Association, and an Associate member of the American Board of Trial Advocates. Mr. Reed and all the members of Bemis, Roach & Reed have been active participants in the Travis County Lawyer referral service.

Your Free Initial Consultation

Call now:

At Bemis, Roach and Reed, if we can't help you, we will try to find the right attorneys for you.

We offer each of our prospective clients a free no obligation one hour phone or office consultation to see if we can help you and if you are comfortable with us. We know how difficult a time like this can be and how hard the decisions are. If we can be of assistance to you and help you find a solution to your issue we will, even if that means referring you to another attorney.

Let's get you Started:

If you could provide us with some basic information about your claim we will get right back with you with a free case evaluation and schedule your Free Consultation Today.