What To Do When Someone I know becomes Disabled Part 1

DISABILITY LAW – What To Do When a Client or Someone I know becomes Disabled – Part 1

Author Attorney Greg Reed:

Updated: 1/31/2023

This was a speech presented by Bemis, Roach & Reed partner Greg Reed at the

CAPITAL AREA PARALEGAL ASSOCIATION in Austin Texas, April 27, 2016

This Document can be downloaded in it’s entirety in PDF format here.

To Part 2 ->

To Part 3 ->

Greg Reed is a partner in the Austin law firm of Bemis, Roach & Reed. He received his law degree in 1991 from the University of Texas at Austin. He is Board Certified in Personal Injury Trial Law by the Texas Board of Legal Specialization and AV rated by Martindale-Hubbell. He has been SuperLawyers® Rated by Thomson Reuters . Mr. Reed is admitted to every federal district in Texas and is a recognized authority in representing claimants with Long Term Disability and Social Security Disability claims.

Acknowledgement

My law partner, Lonnie Roach, researched and wrote the section of this paper related to ERISA disability. Lonnie Roach is a partner in the Austin law firm of Bemis, Roach & Reed. He received his law degree in 1991 from the University of Texas at Austin. He is Board Certified in Personal Injury Trial Law by the Texas Board of Legal Specialization and AV rated by Martindale-Hubbell. He has been SuperLawyers® Rated by Thomson Reuters. Mr. Roach is admitted to every federal district in Texas and focuses his practice on representing claimants with ERISA Long Term Disability claims.

TABLE OF CONTENTS

Part 1

PUBLIC DISABILITY BENEFITS –SSDI AND SSI

- Definition of Disability

- Disability Determination

- Appeal Process

Part 2

PRIVATE DISABILITY – CLAIMS AGAINST DISABILITY INSURERS

- What is an ERISA plan?

- Should be in writing.

- What minimum indicia can define a plan – insurance policy, criterion/critical factors?

- Some plans fall within the Safe Harbor provision.

- What is not an ERISA plan?

- Who are the plan principals?

- Who are fiduciaries?

- What is the obligation of a fiduciary?

Part 3

CONSIDERATIONS WHEN EVALUATING AN ERISA CLAIM:

- Time Limits: Notice of Claim/Proof of Loss/Statute of Limitations

- Claim Process

- Appeal Process

- Exhaustion of Remedies

- Lawsuit For Benefits

- Standard of Review

- Discovery

- Remedy

CONCLUSION

DISABILITY LAW OVERVIEW

Americans are filing for disability benefits at a startling rate. Since 2003, there has been a 44% increase in disability claims filed by people previously in the workplace. Claims for disability by individuals with little or no work experience increased by 29% over the same time. The conjecture is that a combination of an aging population and a slowing economy caused the growth in disability claims.

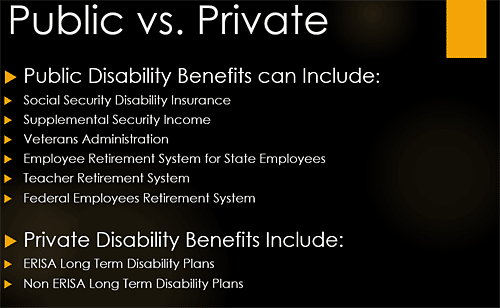

Public or Private

Disability benefits come from many different sources and the rules for obtaining benefits change based on the source of the benefit. This paper will discuss the most common public disability benefits, Social Security Disability Insurance and Supplemental Security Income, and will also discuss the most common private disability insurance. It does not address veteran’s disability benefits or federal employee disability benefits.

The Social Security Administration (SSA) provides two types of disability benefits to qualified individuals. Social Security Disability Insurance (SSDI) is provided under Title II of the Social Security Act. Supplemental Security Income (SSI) is provided under Title XVI of the Act.

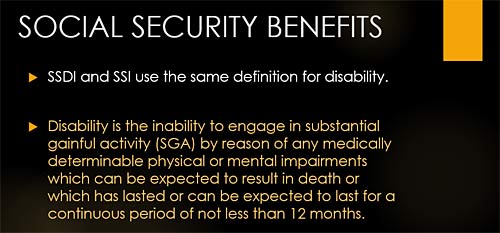

A. Definition of Disability

For all individuals applying for disability benefits under Title II, and for adults applying under Title XVI, the definition of disability is the same. The law defines disability as the inability to engage in any substantial gainful activity (SGA) by reason of any medically determinable physical or mental impairment(s) which can be expected to result in death or which has lasted or can be expected to last for a continuous period of not less than 12 months. SGA means earnings. In 2024, SGA means a person earns at least $1,550 per month. If a person meets the guidelines for blindness, SGA is $2,590 per month.

1. SSDI Non-Disability Qualifications

The Federal Insurance Contributions Act (FICA) is a payroll tax enacted by the federal government to provide money for employees for retirement benefits, Medicare benefits, and disability benefits. In order to qualify for disability benefits under SSDI, a worker must have both recent and sustained work. Eligibility and benefit level are based on age and on the number of “credits” earned in the past. Credits are awarded based on the amount of your earnings. In 2024, a worker receives one credit for each $1,730 of earnings, up to the maximum of four credits per year. There is a misconception that a credit accrues as long as a person works during any quarter of the year. That is not the case. A person can earn all four credits for the year in one day so long as the dollar amount is satisfied. The amount of income needed to qualify for a credit generally goes up slightly every year.

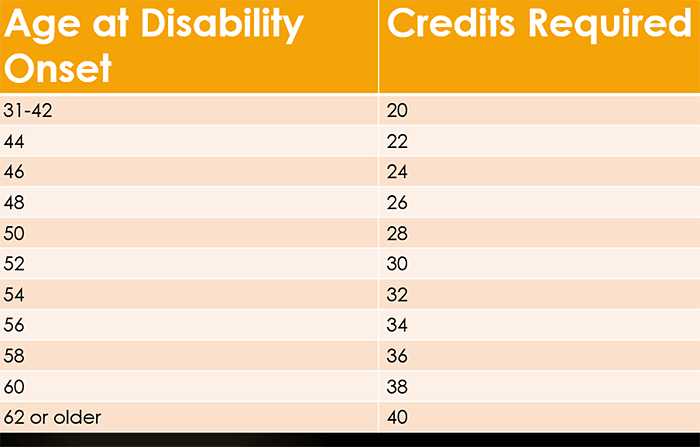

Generally 40 credits are needed, 20 of which were earned in the last 10 years ending with the year the disability began. However, younger workers may qualify with fewer credits.

The rules are as follows:

- Before age 24–You may qualify if you have 6 credits earned in the 3-year period ending when your disability starts.

- Age 24 to 31–You may qualify if you have credit for working half the time between age 21 and the time you become disabled. For example, if you become disabled at age 27, you would need credit for 3 years of work (12 credits) out of the past 6 years (between ages 21 and 27).

- Age 31 or older–In general, you need to have the number of work credits shown in the chart below and remember that 20 of the credits must be in the 10 years immediately before becoming disabled.

Unless you are blind, you must have earned at least 20 of the credits in the 10 years immediately before you became disabled.

Non-working spouse

In very limited circumstances, non-working spouses may qualify for benefits based on the credits earned by the working spouse. If the working spouse is disabled or over 62, the non-working spouse may qualify for benefits at age 62 or at any age if caring for a disabled child under 16. The amount of the benefit is limited to 50% of the benefit of the working spouse.

Former Spouses

A former spouse may be entitled to receive benefits if the following is true:

- The marriage lasted 10 years

- The former spouse is 62 or older

- The former spouse has not remarried

- The former spouse is not personally eligible for disability benefits because of lack of credits OR the amount of the benefit the former spouse is entitled to is less than that of the spouse

Dependents

The dependent, who is an unmarried child of a wage earner who is retired, disabled, or a deceased insured worker is entitled to benefits if he or she is:

- Under age 18

- Under age 19 and a full-time elementary or secondary school student

- Age 18 or older but under a disability which began before age 22

2. SSI Non-Disability Qualifications

SSI is available to individuals who are 65 years of age, blind, or disabled and does not require earned income credits.

Although a claimant may be eligible to receive SSI without any work history, there are very strict

guidelines on the amount of resources one can have before being approved. A single person can have no more than $2,000.00 in resources. If married, the resource cap is $3,000.00 per couple. The following is not counted in the resource total:

- the home you live in and the land it is on

- household goods and personal effects (e.g., your wedding and engagement rings);

- burial spaces for you or your immediate family;

- burial funds for you and your spouse, each valued at $1,500 or less;

- life insurance policies with a combined face value of $1,500 or less;

- one vehicle, regardless of value, if it is used for transportation for you or a member of your household;

- retroactive SSI or Social Security benefits for up to nine months after you receive them (including payments received in installments);

- grants, scholarships, fellowships, or gifts set aside to pay educational expenses for 9 months after receipt.

B. Disability Determination

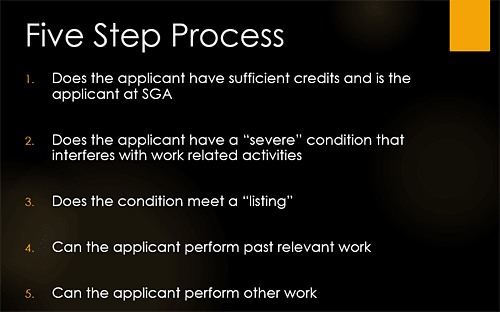

If the applicant meets the non-disability criteria (step 1 of a 5 step process), the applicable Social Security field office generally forwards the claim to the disability determination services (DDS) in the State or other office with jurisdiction to make a disability determination. There are DDSs in each of the 50 States, the District of Columbia, and Puerto Rico. In addition to DDSs, SSA has Federal disability processing units that make disability determinations. In Texas, the DDS is the Texas Department of Assistive and Rehabilitative Services (DARS).

Steps 2 through 5 are:

2. Is the condition “severe”? It must interfere with basic work-related activities.

3. Is the condition found on the list of disabling conditions? If it “meets” the listing, it qualifies.

4. Can the applicant perform past relevant work?

5. Can the applicant perform other work? This step factors in age, education, past work, and transferrable skills.

The Listing of Impairments

In order to qualify, the disability must be caused by a physical or mental impairment. The DDS first examines the claim and the associated medical records to determine whether the claim meets a Social Security “listing.” The categories are identified in Social Security’s Listing of Impairments. Part A of the Listing of Impairments deals with adults. Part B is used for individuals under 18.

The listings in Part A are:

1.0 Musculoskeletal System

2.0 Special Senses and Speech Disorders

3.0 Respiratory System

4.0 Cardiovascular System

5.0 Digestive System Disorders (includes liver)

6.0 Genitourinary Impairments (includes kidney)

7.0 Hematological Disorders

8.0 Skin Disorders

9.0 Endocrine Disorders

10.0 Congenital Disorders that Affect Multiple Body Systems

11.0 Neurological

12.0 Mental Disorders Impairments

13.0 Malignant Neoplastic Diseases

14.0 Immune System Disorders

The listings in Part B are:

100.00 Growth Impairment

101.00 Musculoskeletal System

102.00 Special Senses and Speech Disorders

103.00 Respiratory System

104.00 Cardiovascular System

105.00 Digestive System

106.00 Genitourinary Impairments

107.00 Hematological Disorders

108.00 Skin Disorders

109.00 Endocrine Disorders

110.00 Congenital Disorders that Affect Multiple Body Systems

111.00 Neurological

112.00 Mental Disorders

113.00 Malignant Neoplastic Diseases

114.00 Immune System Disorders

Steps 2 and 3 require medical expertise.

Steps 4 and 5 require vocational expertise.

In every case that makes it past stage 2 (severe impairment), a medical doctor is hired by DDS to assess the claimant’s physical or mental residual functional capacity (RFC). If the condition meets a listing, the claim is approved. If it is severe and does not meet a listing, the vocational expert takes the RFC and uses the limitations identified to determine whether the claimant can perform past relevant work or any other work. If the answer is no, the claim is approved.

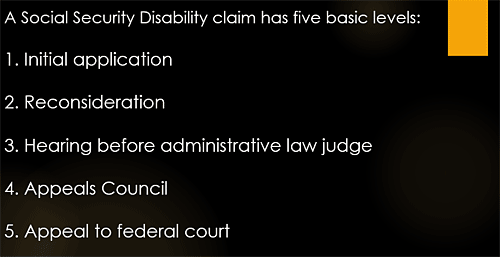

C. Appeal Process

A Social Security Disability claim has five basic levels:

- Initial application

- Reconsideration

- Hearing before administrative law judge.

- Appeals Council

- Appeal to federal court

The time it takes to get a decision on your disability application can vary depending on:

- The nature of your disability;

- How quickly we can get your medical evidence from your doctor or other medical source;

- Whether it is necessary to send you for a medical examination; and

- Whether we review your application for quality purposes.

The real waiting commences when the claimant requests a hearing before an administrative law judge. As of March 9, 2016, the wait times in Texas were:

- Dallas Downtown – 14 months

- Dallas North – 14 months

- Fort Worth – 11.5 months.

- Houston North – 11.5 months

- Houston Bissonnet – 15.5 months

- Rio Grande Valley – 18 months.

- San Antonio – 16 months

Decisions by the Appeals Council frequently take longer than 12 months. In general, a favorable Appeals Council decision remands the case for another ALJ hearing with instructions to the judge on how to proceed.

60 Day Appeal Window

Every appeal must be made within 60 days of receipt of the adverse determination. Social Security will assume that the claimant received the determination no later than five days from the date on the decision. It is the claimant’s burden to prove otherwise.

All steps in the appeal process are mandatory in order to take the case to federal court.

To Part 2 ->

To Part 3 ->

The team of disability lawyers at Bemis, Roach & Reed knows how crucial disability benefits can be for maintaining financial stability. Our attorneys are assisting clients with their disability cases in cities all across Texas. If you are seeking disability benefits because of a sleep apnea diagnosis, contact our attorneys today at no cost to you. Contact us today for a free consultation.

Call 512-454-4000 and get help NOW.

Author: Attorney Greg Reed has been practicing law for 29 years. He is Superlawyers rated by Thomson Reuters and is Top AV Preeminent® and Client Champion Gold rated by Martindale Hubbell. Through his extensive litigation Mr. Reed obtained board certification from the Texas Board of Legal Specialization. Greg is admitted to practice in the United States District Court - all Texas Districts and the United States Court of Appeals-Fifth Circuit. Mr. Reed is a member of the Travis County Bar Association, Texas Trial Lawyers Association, past Director of the Capital Area Trial Lawyers Association, and an Associate member of the American Board of Trial Advocates. Mr. Reed and all the members of Bemis, Roach & Reed have been active participants in the Travis County Lawyer referral service.

Your Free Initial Consultation

At Bemis, Roach and Reed, if we can't help you, we will try to find the right attorneys for you.

We offer each of our prospective clients a free no obligation one hour phone or office consultation to see if we can help you and if you are comfortable with us. We know how difficult a time like this can be and how hard the decisions are. If we can be of assistance to you and help you find a solution to your issue we will even if that means referring you to another attorney.

Or simply call

512-454-4000

to schedule your

Free Consultation

Let's get you Started:

If you could provide us with some basic information about your claim we will get right back with you with a free case evaluation and schedule your Free Consultation Today.